This method ensures that transactions are recorded on the correct date, and financial statements accurately reflect the financial status of the business. Accurate financial statements provide investors, creditors, and other stakeholders with reliable information posting definition in accounting for making informed decisions. Inaccurate posting dates can result in errors in financial statements, which can lead to incorrect decisions and potential legal consequences. Posting dates are the dates on which transactions are recorded in the accounting system.

- Another option for determining the posting date is to use the invoice date.

- Bob has assigned his cash account the number 101 and his vehicle account the number 150 in his accounting system.

- This is the date on which the transaction actually occurred, whether it was a sale, a purchase, or some other type of financial activity.

- It is the date when the journal entry is made to reflect the transaction in the general ledger.

- For most businesses, the date of the transaction is the best option for posting dates because it provides an accurate record of the business’s financial activities.

The ledger for an account is typically used in practice instead of a T-account but T-accounts are often used for demonstration because they are quicker and sometimes easier to understand. Maintaining accurate posting dates is crucial in maintaining accurate bookkeeping records. Companies should ensure that they have a system in place to accurately record posting dates, and that all transactions are recorded in the correct period.

Fan Favorites: Your Most Liked Words of the Day 2023

After an entry is made, the debit and credit are added to a T-account in the categorized journal. At the end of a period, the T-account balances are transferred to the ledger where the data can be used to create accounting reports. Understanding transaction dates and their role in posting dates is essential for accurate financial reporting. By following best practices and choosing the best option for your accounting system, you can ensure that your financial records are accurate and up-to-date. Bob has assigned his cash account the number 101 and his vehicle account the number 150 in his accounting system.

Check out our recent piece on the best accounting software for small businesses. For example, ABC International issues 20 invoices to its customers over a one-week period, for which the totals in the sales subledger are for sales of $300,000. ABC’s controller creates a posting entry to move the total of these sales into the general ledger with a $300,000 debit to the accounts receivable account and a $300,000 credit to the revenue account.

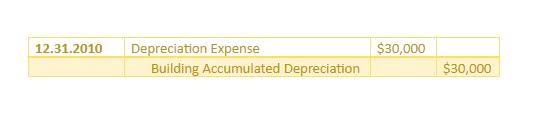

Rules of Posting

Similarly, if an account in a journal entry has been credited it will be posted to the ledger account by entering the same amount on the credit side/column of the respective ledger account. Also, Ledger posting segregates the nature of accounts and their balances which helps in making the financial statements i.e trial balance, profit and loss account and balance sheet. The data is segregated on basis of type, into accounts for liabilities, assets, revenue, expenses and owner’s equity. The format has two sides namely debit and credit with the date of transaction, account by which it is debited or credit, the JF note and respective amounts.